Expert Tips on Choosing the Right Accounting Service Firm for Your Needs

Navigating the world of financial management can be overwhelming—especially for small business owners juggling multiple responsibilities at once. From processing payroll and managing employee benefits to preparing tax returns and ensuring compliance with ever-changing regulations, every financial decision carries significant weight. Without a solid accounting system and the right financial professionals by your side, even profitable businesses can find themselves in disarray.

Whether you’re trying to streamline your payroll services, enhance your bookkeeping processes, or simplify tax preparation, choosing the right accounting service firm is not just a smart move—it’s a critical one. The best accounting and payroll services don’t just crunch numbers; they provide insights that help you make better business decisions, optimize cash flow, and position your company for long-term success.

Today’s small business environment demands more than generic solutions. You need a professional accounting and tax services provider who understands the unique challenges of your industry and offers tailored services such as outsourced bookkeeping, tax filing, and business payroll services. With the right partner, you can offload complex financial tasks and refocus on what matters most: growing your business.

In this detailed guide, we’ll walk you through everything you need to know about selecting a reliable, experienced, and proactive accounting services company. Whether you’re launching a startup, expanding operations, or just need help managing payroll and taxes, our expert tips will help you identify a firm that aligns with your business goals, supports compliance, and adds real strategic value.

Why Choosing the Right Accounting Service Firm Matters

A dependable accounting consultancy firm does far more than simply balance the books or track income and expenses. It acts as a strategic partner in your business journey—helping you gain financial clarity, reduce risks, and unlock opportunities for growth. By delivering accurate financial reporting, expert payroll management, and professional tax and accounting services, such firms provide the insight and support you need to make informed decisions with confidence.

From ensuring your business complies with local and federal tax regulations to optimizing your chart of accounts for better forecasting, a trustworthy accounting and tax services provider becomes an extension of your team. Their role goes beyond data entry—they interpret numbers, offer recommendations, and help you avoid costly mistakes that can hinder your growth. Whether you’re navigating seasonal cash flow fluctuations or planning an expansion, their advice becomes invaluable.

With access to tailored bookkeeping and tax services, professional payroll and accounting services, and strategic financial planning, business owners are empowered to move forward with a clear vision. This kind of proactive support is what distinguishes an average firm from a truly reliable accounting consultancy that prioritizes your long-term success.

The Role of an Accounting Firm in Small Business Success

A truly professional accounting and tax services provider delivers far more than just basic number-crunching. When you choose the right firm, you gain access to a wide array of value-driven services designed to streamline your operations, enhance accuracy, and support your business growth. These include:

Accurate Financial Reporting: Timely, detailed, and error-free financial reports are essential for understanding your business’s performance. With precise reporting from bookkeeping professionals, you can track profitability, monitor expenses, and identify areas for cost-saving opportunities. These insights are crucial for making informed strategic decisions and ensuring transparency with stakeholders and investors.

Efficient Payroll Processing Services: Managing payroll can be time-consuming and stressful—especially with changing tax laws and employee compliance issues. A professional accounting company offering payroll services ensures that employee salaries, deductions, benefits, and tax withholdings are processed correctly and on time. This not only boosts employee satisfaction but also protects your business from costly payroll errors and penalties.

Strategic Tax Planning and Preparation: An experienced tax preparer company doesn’t just file your returns—they help you plan ahead. Strategic tax planning allows small businesses to minimize their tax liabilities legally, take advantage of available credits and deductions, and avoid last-minute surprises. With access to expert tax preparation services, you can feel confident that your business remains compliant with all tax regulations while optimizing its financial standing.

Real-Time Bookkeeping Records and Cash Flow Tracking: Cash flow is the lifeblood of every small business. With outsourced bookkeeping or professional bookkeeping services, you can maintain up-to-date records that reflect your current financial position. This allows you to identify trends, prevent cash shortages, and make smart budgeting decisions that align with your short- and long-term goals.

Support with Software like QuickBooks Online (QBO): Today’s professional accounting service firms utilize advanced tools and platforms like QuickBooks Online (QBO), Xero, and Zoho Books to streamline data entry, automate reconciliations, and generate instant reports. These systems provide real-time financial visibility, making it easier for business owners to manage their finances efficiently from anywhere.

Choosing the right partner for your accounting and tax consulting services means getting more than just compliance—it means building a resilient and scalable financial infrastructure. With the right support in place, you gain the freedom to focus on innovation, customer experience, and long-term business development, while leaving the complexities of accounting, payroll, and tax compliance to trusted experts.

Common Problems Businesses Face with Inadequate Accounting Services

Even the most innovative and customer-focused businesses can face major setbacks if their accounting foundation is weak. Choosing the wrong accounting or tax service provider—or trying to manage complex financial tasks without professional help—can lead to costly mistakes, lost time, and missed growth opportunities. Many small businesses underestimate the importance of professional accounting and tax services until they encounter critical issues like compliance penalties, payroll errors, or cash flow mismanagement.

In this section, we’ll explore the most common challenges and pitfalls businesses face when they rely on unqualified, outdated, or inconsistent accounting services. By understanding these risks, you can better evaluate your current financial processes and identify the signs that it may be time to upgrade to a more reliable and experienced accounting consultancy.

1. Poor Payroll Management

One of the most critical areas where small businesses often falter is payroll management. When payroll services are handled improperly—whether due to lack of expertise, outdated processes, or insufficient technology—the consequences can be severe.

Common issues include:

- Payroll tax services inaccuracies: Incorrect payroll tax calculations or missed filings can lead to penalties, audits, and long-term financial liabilities.

- Delayed employee payments: Failure to pay staff accurately and on time not only damages trust and morale but also risks legal repercussions under labor laws.

- Poor payroll planning and compliance penalties: Without professional payroll accountants and proactive planning, businesses may overlook changing regulations or miscalculate employer obligations—resulting in hefty fines.

- Incompatible payroll management systems: Using outdated or non-integrated systems makes it difficult to manage pay periods, track hours, handle deductions, and issue year-end tax forms efficiently.

Choosing a firm that specializes in business payroll services and offers end-to-end payroll and accounting services ensures accuracy, timeliness, and regulatory compliance—while freeing you to focus on running your business.

2. Inaccurate Bookkeeping and Tax Filings

Reliable bookkeeping is the backbone of sound financial management. Unfortunately, many small businesses rely on underqualified bookkeeping professionals or attempt to manage it themselves, leading to errors that snowball over time.

Issues that stem from inefficient bookkeeping include:

- Misclassification of expenses and business deductions: This can result in inaccurate financial statements, tax overpayments, or audit triggers.

- Missed deadlines for tax preparation services: Late filings, estimated tax miscalculations, or missed quarterly payments can create penalties and stress at year-end.

- Lack of clarity in financial bookkeeping: Disorganized records and unclear categorization can prevent business owners from understanding their cash flow, budgeting effectively, or securing loans and investments.

With expert tax bookkeeping services and professional bookkeeping services, your records stay clean, your taxes stay compliant, and your decisions are data-driven.

3. Lack of Industry Expertise

Every industry operates with its own set of financial requirements, tax regulations, and reporting standards. Working with a generalist accounting firm may result in missed nuances, overlooked deductions, or noncompliance with industry-specific rules.

For example:

- Construction businesses require construction bookkeeping services that account for project-based costing, job tracking, subcontractor compliance, and WIP (work-in-progress) reporting.

- Medical practices and healthcare providers benefit from medical accounting services that navigate insurance reimbursements, HIPAA compliance, and physician payroll complexities.

- Startups and tech companies need forward-thinking financial planning, equity compensation accounting, and cash flow forecasting tools.

Without industry-specific accounting expertise, businesses risk mismanagement of funds, underutilized tax advantages, and financial blind spots that hinder growth.

4. Limited Software Integration

In today’s digital economy, using the right financial software is no longer optional—it’s essential. Yet, many small businesses still operate with outdated systems, spreadsheets, or software that doesn’t integrate well with their operations.

Consequences of poor software integration include:

- Inefficient workflows: Manual data entry, duplicate work, and slow reconciliations eat into valuable time and resources.

- Data errors: Without automation and built-in error-checking, businesses risk reporting inaccuracies that can affect everything from tax filings to cash flow forecasts.

- Limited real-time visibility into finances: If your systems don’t provide up-to-date dashboards and reports, you’re forced to make decisions based on outdated or incomplete information.

Partnering with a firm that supports QuickBooks bookkeeping, outsourced accounting and bookkeeping services, and other modern platforms ensures that your financial systems are optimized, connected, and scalable.

Key Factors to Consider When Choosing an Accounting Service Firm

Selecting the right accounting service firm is one of the most important decisions a business owner can make. Whether you’re launching a startup, managing a growing enterprise, or navigating the complexities of tax season, your accounting partner plays a vital role in your financial success. But with so many firms offering bookkeeping and tax services, payroll management, and outsourced accounting, how do you determine which one is the right fit for your needs?

An ideal accounting firm should go beyond basic number-crunching. It should act as a trusted advisor—offering tailored solutions, technology integration, industry-specific guidance, and forward-thinking strategies. From managing payroll services and preparing taxes to optimizing cash flow and providing strategic financial insights, the right firm empowers you to focus on growing your business, not getting buried in the numbers.

In this section, we’ll outline the essential factors to consider when evaluating professional accounting and tax services, ensuring that your chosen partner is not only qualified and experienced but also aligned with your business goals and industry requirements.

1. Industry-Specific Experience

One of the most overlooked yet essential factors when choosing an accounting service firm is industry experience. Every sector—whether it’s construction, healthcare, retail, or technology—has its own financial complexities, regulatory requirements, and accounting best practices. A firm that understands the intricacies of your industry can offer far more than general compliance—they bring strategic insight, relevant tax-saving opportunities, and real-world solutions tailored to your challenges.

For example, construction company accounting involves progress billing, job costing, contractor compliance, and managing subcontractor payments. Meanwhile, healthcare accounting services must navigate insurance reimbursements, patient billing systems, and compliance with healthcare regulations. Startups and accounting go hand-in-hand with cash burn management, investor reporting, and equity distribution tracking.

Working with a professional accounting company that specializes in your field ensures you won’t be stuck explaining the basics—they’ll already speak your language and bring added value from day one.

2. Range of Services Offered

Not all accounting firms are created equal. Some may only offer basic bookkeeping, while others provide a complete suite of tax and accounting services to support your business across all financial functions. Choosing a full-service accounting service firm gives you the flexibility to scale up or down as your needs evolve, without switching providers.

A comprehensive firm should offer:

- Professional bookkeeping services to maintain clean, up-to-date records

- Payroll solutions that ensure timely and accurate employee compensation, tax withholdings, and reporting

- Tax preparation and bookkeeping services to streamline year-end filings and strategic planning

- Outsourced accounting and bookkeeping services for businesses looking to reduce in-house overhead while gaining expert financial oversight

Whether you need one-time tax filing or ongoing payroll and accounting services, working with a provider that offers a wide array of services means you’re covered at every stage of business growth.

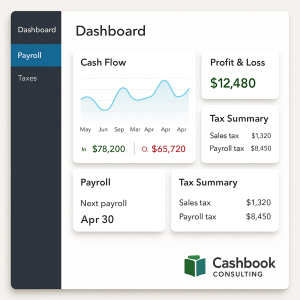

3. Software Compatibility

In today’s fast-paced, digital-first environment, your accounting firm should be fluent in the technology that powers your business. A modern accounting service for business must be able to seamlessly integrate with your existing software platforms to reduce manual effort, eliminate redundancies, and improve decision-making through real-time insights.

Ensure your provider offers:

- QuickBooks Online bookkeeping services for streamlined financial tracking, automation, and cloud access

- Cloud-based payroll management systems that simplify wage calculations, direct deposits, and tax filings while remaining compliant with current laws

- Custom dashboards for accounting reports that provide visual clarity on KPIs, cash flow, and financial performance

Software compatibility not only improves operational efficiency but also enhances your ability to stay agile, scalable, and data-informed. Look for an accounting firm that’s tech-savvy and proactive in recommending tools that will elevate your financial operations.

4. Customization and Personalization

No two businesses are exactly alike—so why settle for generic accounting solutions? The best professional accounting and tax services are tailored to fit the specific needs of your business size, model, industry, and growth stage. Whether you’re a sole proprietor, a growing startup, or a midsize enterprise, personalized service makes all the difference in getting the right insights at the right time.

Avoid firms that offer one-size-fits-all packages without understanding your operations or goals. Instead, choose a team that offers customized accounting services and takes the time to get to know your business. Personalized service includes:

- Developing custom financial reports that align with your KPIs

- Setting up your chart of accounts based on your revenue model

- Offering advice on tax strategies relevant to your location and structure

- Creating workflows that match your existing processes

With personalized accounting services, your financial partner becomes a true advisor—not just a number cruncher—capable of supporting your success with proactive guidance, not just reactive support.

Comparing Bookkeeping vs. Accounting Services

For many small business owners, the terms bookkeeping and accounting are often used interchangeably. However, while they are closely related and equally essential to a business’s financial health, they serve distinct roles in the overall financial management process. Understanding the difference between bookkeeping and accounting services is critical when deciding what type of support your business truly needs.

Bookkeeping focuses on the accurate recording of daily financial transactions—such as sales, purchases, receipts, and payments. It forms the foundation upon which all financial reporting and tax preparation are built. On the other hand, accounting involves analyzing, interpreting, and reporting that data to help business owners make strategic decisions, ensure compliance, and plan for future growth.

In this section, we’ll break down the key differences between professional bookkeeping services and professional accounting and tax services, explore where they overlap, and help you determine which services are right for your business—whether you’re looking to manage payroll, track cash flow, or prepare for tax season.

Bookkeeping Services

Bookkeeping is the first step in the financial management cycle, and it plays a crucial role in helping small businesses maintain financial order. Handled by skilled bookkeeping professionals, these services focus on organizing and recording the financial activities of a business on a day-to-day basis. Bookkeepers ensure that every transaction is logged correctly, categorized properly, and available for reference at any time.

Key responsibilities of professional bookkeeping services include:

- Recording transactions: Every sale, purchase, expense, and receipt is meticulously documented, providing an accurate picture of your business’s financial activities.

- Reconciling bank statements: Bookkeepers match the internal financial records with bank statements to detect discrepancies and ensure that all records are up-to-date and error-free.

- Tracking expenses and invoices: They monitor payables and receivables to maintain cash flow stability and prevent missed payments or lost income.

These services are best suited for businesses that need real-time financial visibility and up-to-date records. Whether you’re a growing startup or an established small business, leveraging real-time bookkeeping accounting services ensures transparency, supports decision-making, and forms the foundation for effective tax preparation and accounting services later on.

Accounting Services

While bookkeeping lays the groundwork, accounting services take it a step further. Performed by accounting tax professionals, Certified Public Accountants (CPAs), or experienced financial advisors, these services interpret financial data, generate reports, and provide actionable insights to help you steer your business toward growth and compliance.

Professional accounting and tax services include:

- Tax filing and compliance: Accountants ensure that your business adheres to federal, provincial, or state tax regulations while taking advantage of all eligible deductions and credits.

- Financial reporting accuracy: They prepare detailed reports such as profit and loss statements, balance sheets, and cash flow statements—critical for understanding performance and satisfying stakeholders.

- Advanced tax strategies: Beyond simple preparation, accountants offer proactive tax planning to help reduce liabilities and prepare for seasonal or long-term financial obligations.

Unlike bookkeeping, which is more transactional and operational, accounting is analytical and strategic. With the help of professional accounting services, businesses gain a clearer understanding of their financial position and receive expert guidance for budgeting, investing, and scaling operations.

Why You Need Both

While bookkeeping and accounting are separate functions, they are inherently connected. Without accurate bookkeeping, accounting professionals won’t have reliable data to analyze. And without professional accounting services, bookkeeping data remains raw and underutilized.

A combination of both services ensures holistic business accounting and bookkeeping support—enabling small businesses to stay compliant, plan for the future, and make informed decisions based on real-time financial data. Many companies today opt for outsourced bookkeeping and accounting services to gain access to both levels of expertise without hiring a full-time in-house team.

Benefits of Outsourcing Accounting and Payroll

As small businesses scale, managing finances in-house can become increasingly complex and time-consuming. From navigating payroll tax regulations to keeping financial records up-to-date, the administrative burden can quickly pull business owners away from core operations. That’s where outsourcing comes in. By partnering with a professional accounting company, businesses can shift the weight of day-to-day bookkeeping, tax compliance, and payroll services to experienced professionals.

Outsourcing accounting and payroll services isn’t just about reducing workload—it’s about gaining efficiency, accuracy, and strategic insight. Whether you’re looking for bookkeeping services for small business, need help managing payroll for a growing team, or want expert support with tax preparation, outsourcing allows you to access top-tier expertise without the cost of hiring a full in-house team.

In this section, we’ll explore the key benefits of outsourcing your payroll and accounting services, and why more businesses are choosing this flexible, cost-effective approach to streamline financial operations and focus on growth.

1. Cost Savings

One of the most immediate and tangible benefits of outsourcing accounting and payroll services is the significant reduction in operational costs. Hiring in-house accountants, payroll managers, and bookkeepers involves not only salaries but also benefits, training, office space, and HR management. These expenses can be burdensome for small to medium-sized businesses operating on tight budgets.

By choosing outsourced bookkeeping and payroll services, companies eliminate the need for full-time staff and instead pay only for the services they use. Outsourced firms already have trained professionals, software systems, and quality control in place—so you don’t have to invest in infrastructure or technology from scratch.

This model is especially advantageous for startups and growing businesses that need expert financial services but can’t yet afford to build an internal accounting department. In the long run, outsourcing helps reduce bookkeeping cost, minimize administrative overhead, and allocate financial resources more strategically.

2. Expertise on Demand

When you outsource to a professional accounting company, you gain instant access to a team of seasoned financial experts without the delays and expenses of recruitment and onboarding. These include:

- Tax experts and accountants who stay up-to-date with local and international tax laws and regulations

- Payroll accountants who understand deductions, labor laws, benefits administration, and year-end reporting

- Bookkeeping professionals who ensure accurate and consistent record-keeping

This level of expertise is often hard to find in a single in-house hire, especially when your business needs fluctuate. Outsourcing allows you to tap into professional tax and accounting services as needed—whether it’s for seasonal tax preparation, year-end audits, or monthly payroll processing—without long-term commitments or skill gaps.

3. Enhanced Accuracy and Compliance

Tax laws and financial regulations are constantly evolving, and non-compliance—even unintentional—can lead to severe penalties, audits, or damaged reputations. With professional accounting and tax services, businesses benefit from high standards of accuracy, meticulous documentation, and up-to-date compliance practices.

Outsourced accounting firms use standardized procedures and industry-leading accounting software to ensure that financial statements, payroll records, and tax filings are precise and audit-ready. This reduces the risk of:

- Errors in payroll processing

- Incorrect tax filings or missed deadlines

- Improper classification of income or expenses

- Non-compliance with employment or sales tax laws

By outsourcing to a qualified firm, you not only gain peace of mind but also improve the overall financial health and transparency of your business operations.

4. Scalable Solutions

Every business evolves over time, and your financial needs will shift as you grow. One of the greatest advantages of outsourcing is the scalability it offers. Whether you’re managing a handful of employees or expanding into new markets, outsourced services can easily adapt to your changing requirements.

For example:

- Online business bookkeeping services provide real-time access and cloud integration for digital-first companies

- Enterprise-level payroll handling accommodates complex payment structures, bonuses, and benefits for larger organizations

- Customizable service packages allow you to scale up during tax season or high-growth periods and scale down when things stabilize

With this flexibility, your business can continue to grow without worrying about hiring new financial staff or overburdening your existing team. Instead, your bookkeeping and payroll services grow with you, providing consistent quality and support at every stage of development.

How to Evaluate Payroll Services for Small Business

Choosing the right payroll service provider is a critical decision that can directly impact your business’s efficiency, compliance, and employee satisfaction. While payroll may seem like a simple process of issuing paychecks, it actually involves complex tax calculations, legal obligations, and reporting requirements. For small business owners, managing this in-house can be time-consuming and risky—especially without a background in payroll accounting.

That’s why many companies turn to professional payroll services to streamline operations, reduce errors, and ensure compliance with ever-changing tax laws. However, not all payroll providers offer the same level of service, technology, or support. It’s essential to evaluate potential partners carefully to ensure they align with your specific business needs.

In this section, we’ll break down the key factors to consider when evaluating payroll services for small business, helping you choose a provider that offers accurate, efficient, and scalable solutions to manage your payroll confidently.

1. Understand Their Payroll Processing System

The foundation of a dependable payroll service lies in its processing system. As a small business owner, you need to ensure that the provider you choose offers a platform that is both efficient and accurate. Payroll is not just about issuing paychecks—it involves meticulous calculations, secure data handling, and reliable integration with your existing systems.

When evaluating a provider, consider:

- Speed and accuracy of payroll processing: Timely payroll ensures that your employees are paid correctly and on schedule. Look for providers with a reputation for precise calculations and prompt service delivery, especially during high-volume periods.

- Tax calculation and payroll tax management: The service should accurately withhold and file payroll taxes, handle deductions, and submit government forms on your behalf. Mistakes here can lead to hefty penalties or legal trouble.

- Integration with your time tracking tools: Modern payroll solutions should seamlessly integrate with your existing attendance or timesheet systems. This reduces manual entry, prevents errors, and streamlines workflows.

A reliable payroll management system reduces administrative headaches and gives you more time to focus on strategic business activities. Look for a provider offering automation, intuitive dashboards, and compliance-backed processing.

2. Ask About Tax Compliance

Payroll compliance is one of the most important aspects of running a business—and one of the most complicated. Failing to comply with local, state/provincial, and federal tax regulations can lead to serious consequences, from financial penalties to legal audits. A trusted payroll service business will not only handle calculations but also stay on top of the latest tax laws to ensure you remain compliant.

Key areas to evaluate include:

- Payroll tax services: Confirm that the provider calculates, withholds, and remits payroll taxes correctly for all employee types—whether salaried, hourly, part-time, or contract.

- Local and federal compliance: Laws change frequently, and compliance requirements vary by location. Make sure the service is well-versed in both local and federal employment laws and updates you when new regulations come into effect.

- Reporting and year-end filings: Your payroll service should prepare and file all required year-end documents, such as W-2s, 1099s, or T4 slips, ensuring they are accurate and submitted on time.

Choosing payroll accountants or tax professionals with a strong compliance track record minimizes the risk of errors, helps avoid audits, and ensures peace of mind during tax season.

3. Look for Full-Service Solutions

For maximum efficiency, many small businesses opt for full-service payroll and accounting services that handle everything from paychecks to tax filings under one roof. This bundled approach ensures consistency, reduces communication breakdowns, and simplifies financial reporting across your organization.

A full-service payroll provider should offer:

- Tax filing services: End-to-end filing for local, provincial/state, and federal payroll taxes, including quarterly and annual forms.

- Garnishments management: Support for automatic deductions such as child support, wage garnishments, and court-ordered payments.

- Direct deposit capabilities: Fast, secure, and flexible direct deposit options for your employees, improving payment reliability and reducing administrative time.

- Employee self-service portal: A secure, user-friendly portal where employees can access pay stubs, tax documents, and personal payroll history—reducing HR inquiries and improving employee satisfaction.

Choosing a provider that combines professional accounting and tax services with comprehensive business payroll services creates a seamless system that grows with your company, improves operational efficiency, and ensures every payroll run is hassle-free.

The Hidden Costs of DIY Bookkeeping and Payroll Management

For many small business owners, handling bookkeeping and payroll in-house seems like a practical, cost-saving solution—especially in the early stages of business. While the intention may be to reduce expenses, the reality is that DIY bookkeeping and payroll management often come with hidden costs that quietly erode time, productivity, and profitability. What seems like a budget-friendly move can actually lead to inefficiencies, costly errors, and missed growth opportunities.

Here are the often-overlooked risks and expenses that come with trying to manage your own books and payroll without professional support:

• Time Lost

DIY bookkeeping and payroll responsibilities can easily consume 6 to 10 hours per week—time that could be spent serving clients, acquiring new business, improving operations, or developing your products and services. Small business owners already wear multiple hats, and adding complex financial management tasks to the mix stretches resources thin. The time invested in manually inputting transactions, reconciling statements, calculating payroll taxes, and preparing financial reports diverts attention from higher-value, revenue-generating activities.

Outsourcing to a team of bookkeeping professionals or payroll accountants allows you to reclaim your time and focus on what truly matters—growing your business.

• Errors and Penalties

One of the most significant dangers of DIY financial management is the risk of errors. Whether it’s a miscalculated payroll tax, a forgotten tax deadline, or misclassified expenses, mistakes can trigger audits, incur fines, and damage your credibility with tax authorities. Without access to professional tax and accounting services, business owners often struggle to stay compliant with changing regulations, resulting in avoidable penalties and unnecessary stress.

A single payroll error could cost your business hundreds or even thousands of dollars, not to mention potential legal issues or reputational damage. This is why outsourced payroll services and professional tax preparation aren’t just convenient—they’re a strategic investment in financial stability.

• Lack of Tax Strategy

DIY bookkeeping typically focuses on day-to-day data entry and payment tracking, with little room for proactive tax planning. Without the guidance of an experienced tax preparer company or accounting tax professionals, you risk missing out on key deductions, credits, and strategies that could lower your tax liability. This results in overpaying taxes, inaccurate filings, or missed opportunities for reinvestment.

Professional tax bookkeeping services and accounting services for business go beyond compliance—they help optimize your tax position, improve cash flow, and support smarter business decisions.

Why Professional Help Is Worth the Investment

When you partner with a trusted firm like Cashbook Consulting, you eliminate the guesswork and inefficiencies of DIY financial management. Our team of payroll accountants, bookkeeping professionals, and accounting tax experts work together to ensure your financial records are accurate, your payroll is processed on time, and your taxes are filed with confidence.

Instead of spending hours trying to “manage my payroll” or interpret complex tax laws on your own, you can rely on a professional accounting company to handle it all—saving you time, money, and risk. The return on investment (ROI) of hiring experts far outweighs the perceived cost of outsourcing, especially when you consider the long-term value of accuracy, compliance, and strategic insight.

How Accounting and Bookkeeping Services Support Growth

Every successful business relies on a strong financial foundation—and that begins with professional accounting and bookkeeping services. When your bookkeeping for business and payroll services are handled by experts, you gain far more than just clean ledgers and timely tax filings. You gain the confidence and clarity needed to grow your business strategically.

Here’s how professional services help drive business growth:

- You get a clear financial picture of your business at all times: With real-time bookkeeping, up-to-date records, and consistent cash flow tracking, you always know where your business stands financially. This allows you to make informed decisions, avoid surprises, and respond quickly to market changes.

- You can secure loans or attract investors with accurate books: Whether you’re seeking a business loan, credit line, or investor funding, well-maintained financial statements are a must. Lenders and investors rely on accurate profit and loss statements, balance sheets, and cash flow forecasts to assess the health and potential of your business. Professional bookkeeping services ensure these documents are not only accurate but also professionally presented—building trust with potential stakeholders.

- You can scale confidently, knowing your back office is in expert hands: As your business grows, so do your financial responsibilities—employee payroll, vendor payments, tax planning, and regulatory compliance all become more complex. With outsourced accounting and bookkeeping services, you don’t need to worry about hiring an in-house team or overextending your time. Instead, you gain scalable support that grows alongside your business.

From startups to expanding enterprises, having professional accounting services for business in place ensures stability, reduces financial risk, and allows you to focus your energy on innovation and customer service.

The Role of Financial Reports in Strategic Planning

Financial reports are far more than historical records—they are powerful tools that guide future strategy. When your reports are timely, accurate, and insightful, they become a roadmap for growth. A qualified team of CPA accounting professionals ensures that your data is more than just numbers—it tells a story about where your business has been, where it is now, and where it’s heading.

Here’s how high-quality accounting reports support strategic planning:

- Budgeting and forecasting: Forecasts based on actual data help you anticipate revenue, plan expenditures, and allocate resources efficiently. With accurate projections, you can prepare for seasonal shifts, upcoming expenses, or opportunities for reinvestment.

- Identifying waste or profit leaks: Financial statements can uncover inefficiencies in spending, underperforming products, or excessive overhead. This allows you to tighten operations and increase margins. For instance, a monthly income statement might reveal rising vendor costs or unnoticed subscription fees.

- Setting realistic sales and cost goals: Comparing projected vs. actual performance through real-time reports helps management set SMART goals and track progress. This is critical for managing marketing budgets, inventory, and production schedules.

- Tax planning and quarterly estimates: Regular financial reviews enable proactive tax planning. Your accounting team can calculate estimated taxes, recommend strategic deductions, and prevent year-end tax shocks. This is especially vital for small businesses that may face penalties for underpayment.

By leveraging financial reporting prepared by professional accounting and tax services, your business can operate with precision and plan with purpose. Every line on your income statement, balance sheet, and cash flow report plays a role in guiding smart decisions—whether you’re preparing for growth, navigating a downturn, or entering new markets.

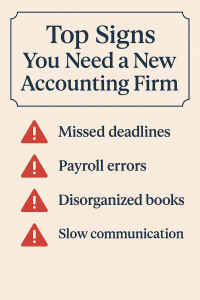

Top Signs You Need to Switch Your Accounting Provider

Choosing the wrong accounting or bookkeeping firm can cause more harm than good. While a professional accounting company should bring clarity and control to your finances, a poor choice can lead to disorganization, compliance issues, and costly mistakes. Here are some warning signs to look out for when evaluating or working with financial service providers:

• Missed Deadlines or Slow Communication

Timeliness is critical in managing payroll, filing taxes, and generating financial reports. If your accounting service consistently misses deadlines, delays payroll processing, or fails to respond to urgent requests, it’s a major red flag. Missed deadlines can result in tax penalties, frustrated employees, and lost financial opportunities. Effective payroll services and tax and accounting services should be timely, responsive, and proactive in their communication—helping you meet all legal and operational requirements without stress.

• Inconsistent or Incomplete Bookkeeping Records

Accurate and up-to-date records are the backbone of smart financial decision-making. If you notice gaps, errors, or inconsistencies in your financial reports, it’s a sign that your bookkeeping professionals may not be maintaining proper controls. Incomplete records can affect everything from loan applications to tax audits and profit forecasting. A qualified provider of professional bookkeeping services ensures that every transaction is logged correctly, accounts are reconciled regularly, and financial data is accessible and reliable.

• No Strategic Tax Advice or Year-End Planning

Basic tax filing is not enough. A high-quality accounting firm should provide strategic year-round support, helping you plan for quarterly payments, identify deductions, and make informed financial moves before year-end. If your current provider only contacts you at tax time and offers no guidance on tax strategy or business planning, you may be leaving money on the table. Engaging with professional accounting and tax services gives you access to experienced tax preparers who help you reduce liabilities and build long-term financial strategies.

• Poor Software Support (Not Using QuickBooks QBO or Similar)

Technology plays a vital role in efficient financial management. If your service provider doesn’t use modern accounting tools such as QuickBooks Online (QBO), Xero, or other cloud-based systems, you’re likely missing out on automation, real-time reporting, and simplified collaboration. Poor software support leads to data silos, manual errors, and delays in financial visibility. The best outsourced bookkeeping and accounting services for business are powered by robust software solutions that integrate seamlessly with your operations.

Frequently Asked Questions (FAQs)

1. What’s the difference between a bookkeeper and an accountant?

While bookkeepers and accountants both play vital roles in your business’s financial health, their responsibilities differ in scope and depth. A bookkeeper focuses on the daily financial operations—such as recording transactions, managing accounts payable and receivable, reconciling bank statements, and maintaining ledgers. Their work ensures that all financial data is current and organized.

An accountant, on the other hand, uses that data to perform deeper financial analysis. They prepare financial statements, handle tax preparation and planning, advise on compliance issues, and develop long-term financial strategies. At Cashbook Consulting, we provide both professional bookkeeping services and expert accounting tax professionals under one roof—giving you a complete and seamless financial management experience.

2. Why should I outsource my accounting services?

Outsourcing your accounting and bookkeeping services offers numerous advantages, especially for small and mid-sized businesses. First, it saves time—freeing you from repetitive financial tasks so you can focus on operations and growth. Second, it reduces the risk of costly mistakes by entrusting your books to qualified professionals. Third, it ensures tax compliance with the latest laws, avoiding penalties and fines. Finally, outsourcing provides flexible access to a team of bookkeeping professionals, payroll accountants, and tax experts, without the need to hire and manage full-time staff.

Whether you’re looking for monthly bookkeeping services for small business, tax return filing, or business payroll services, outsourcing delivers high-value expertise at a lower cost.

3. How often should I update my books?

Ideally, your bookkeeping records should be updated weekly or biweekly to maintain real-time financial accuracy. This ensures you always have a clear view of your cash flow, outstanding invoices, and expense patterns. At a minimum, monthly updates are essential for accurate financial reporting and tax preparation.

At Cashbook Consulting, we offer real-time bookkeeping accounting services that keep your records current, automated, and ready for decision-making—whether you’re preparing for tax season or applying for financing.

4. Is QuickBooks Online better than traditional spreadsheets?

Absolutely. Traditional spreadsheets like Excel may work for very small businesses or short-term tracking, but they come with limitations—such as version errors, manual data entry, and lack of integration. QuickBooks Online (QBO) is a powerful cloud-based accounting solution that automates tasks, syncs with your bank accounts, generates financial reports instantly, and reduces the risk of human error.

With QuickBooks Online bookkeeping services, you gain:

- Real-time financial insights

- Seamless payroll and tax integrations

- Secure cloud access from any device

- Automated reconciliation and reporting tools

Cashbook Consulting specializes in QBO setup, management, and training, ensuring you get the most out of modern accounting software.

5. Do you offer services for my industry?

Yes! Cashbook Consulting proudly serves clients across a broad range of industries, each with its own financial complexities. Whether you’re in construction, real estate, healthcare, e-commerce, or a tech startup, our team offers industry-specific accounting solutions tailored to your needs. We understand the regulations, reporting standards, and tax requirements unique to each sector, allowing us to deliver personalized services that support compliance, efficiency, and long-term growth.

From construction bookkeeping services to specialized tax strategies for digital businesses, our expertise ensures that your books are not only accurate but optimized for your business model.

6. How do I know I need help with my payroll?

If you’re experiencing payroll delays, tax filing errors, employee complaints, or you’re spending too much time calculating wages and deductions—it’s time to consider outsourcing. Common signs include:

- Missed payroll deadlines or late employee payments

- Incorrect tax withholdings or IRS penalties

- Overwhelming complexity in managing multi-state payroll

- Inconsistent tracking of paid time off, bonuses, or garnishments

At Cashbook Consulting, our payroll services for small business are designed to eliminate those headaches. We handle everything from direct deposits and payroll tax services to employee portals and year-end reporting—giving you back your time and peace of mind.

✅ Ready to Take Control of Your Finances?

Still unsure whether you need expert help with payroll services, bookkeeping, or tax preparation? Don’t leave your financial success to chance.

At Cashbook Consulting, we specialize in helping small and medium-sized businesses thrive through accurate, insightful, and fully personalized accounting services. Whether you’re drowning in spreadsheets, struggling to file taxes, or need payroll handled with precision—our team of certified professionals is here to simplify your workload and support your growth.

🔹 Outsourced Bookkeeping Services – Keep your records clean, current, and compliant.

🔹 Professional Tax and Accounting Services – Strategic tax planning and error-free filings.

🔹 Payroll Management Solutions – Accurate, on-time payments and tax withholdings, every time.

🔹 QuickBooks Online Experts – Seamless setup, management, and reporting.

Our team of seasoned accounting and tax professionals provides hands-on support, scalable solutions, and unmatched accuracy—so you can focus on running your business, not your back office.

💼 Let’s Grow Together

📅 Book your FREE consultation today and experience the Cashbook Consulting difference.

📍 Cashbook Consulting

🌐 https://cashbookacc.com

📧 Email: info@cashbookacc.com

📞 Phone: +1 (201) 979-3825

📍 Serving clients across the US & Canada