- The Long-Term Financial Impact of Hiring Expert Tax Accountants

Hiring tax accounting professionals is not just about short-term compliance; it directly affects the long-term financial health of a business. Businesses that rely on professional accounting and tax services tend to make better decisions because they have access to accurate financial data.

Expert accountants improve:

- Financial management and forecasting

- Business financial practices

- Budgeting and expense control

- Risk management

With business accounting and bookkeeping handled professionally, owners gain clarity on profit margins, cash flow cycles, and investment readiness.

- How Expert Accountants Help Reduce Business Risk

One of the most overlooked benefits of professional tax & accounting services is risk reduction.

Compliance Risks

Failing to comply with tax laws accounting can result in audits, penalties, and reputational damage. A tax professional CPA ensures proper filings and documentation.

Payroll Risks

Incorrect payroll processing or payroll tax management can lead to employee dissatisfaction and legal consequences. Using payroll services and payroll tax services protects your business.

Financial Reporting Risks

Poor accounting leads to:

- Inaccurate financial statements

- Weak accounting reports

- Decision-making based on incorrect data

- Accounting Support for Business Expansion and Scaling

As businesses grow, financial complexity increases. Accounting services for business support expansion by offering:

- Scalable outsourced accounting solutions

- Payroll planning for larger teams

- Advanced tax planning 2025 strategies

- Improved financial reporting accuracy

Whether you are expanding operations, hiring employees, or entering new markets, professional accounting company support ensures stability.

- The Role of Financial Bookkeeping in Strategic Decision-Making

Accurate financial bookkeeping allows businesses to:

- Track performance in real time

- Identify unnecessary expenses

- Monitor profitability by product or service

Using comprehensive bookkeeping and bookkeeping accounting services, businesses gain insights that support smarter strategies.

This is especially valuable for:

- Commerce business owners

- Startups and accounting planning

- Small business accountancy needs

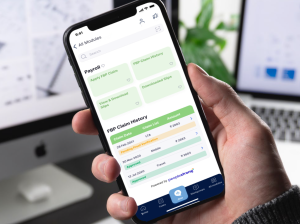

- Payroll and Tax Integration: Why It Matters

Many businesses treat payroll and tax as separate tasks, which leads to errors. Integrated payroll and tax services improve efficiency.

Benefits include:

- Accurate payroll tax services

- Simplified payroll tax management

- Fewer year-end surprises

Using accounting and payroll services ensures consistency across all financial records.

- Cost Transparency and Bookkeeping Pricing Explained

Business owners often worry about bookkeeping cost and bookkeeping charges. Professional firms offer transparent pricing models that help businesses budget accurately.

Why Professional Services Are Cost-Effective

- Fewer penalties

- Reduced internal staffing costs

- No need for constant accounting software training

Outsourcing accounting services for small business often costs less than hiring in-house staff.

- Accounting Support for Online and Remote Businesses

With the rise of digital businesses, online business bookkeeping has become essential.

Professional firms help with:

- Bookkeeping for online business

- Managing multi-currency transactions

- Cloud-based QuickBooks Online (QBO online)

- Real-time financial reporting

This ensures smooth operations regardless of location.

- How Expert Accountants Solve Complex Tax Issues

Businesses often face complex tax issues such as:

- Back taxes

- Multi-state tax compliance

- Industry-specific deductions

Tax experts accountants use advanced tax strategies to resolve issues while ensuring compliance.

![]() Frequently Asked Questions (FAQs)

Frequently Asked Questions (FAQs)

- Why should I hire expert tax accountants instead of doing taxes myself?

Expert tax accountants understand tax laws accounting, ensure accurate filings, and help maximize deductions. This reduces errors, saves time, and prevents penalties.

- Are professional accounting services worth the cost for small businesses?

Yes. Accounting services for small business improve financial management, reduce compliance risks, and often cost less than in-house accounting.

- What is the difference between bookkeeping and accounting?

Bookkeeping focuses on recording transactions, while accounting analyzes financial data and provides strategic insights. Understanding bookkeeping vs accounting helps businesses choose the right services.

- How do payroll services help my business?

Payroll services manage salaries, deductions, and payroll tax services accurately, ensuring compliance and timely payments.

- Can I outsource bookkeeping and accounting together?

Yes. Many firms offer outsourced accounting and bookkeeping services, which improve consistency and reduce operational burden.

- Do I need a CPA for my business?

A CPA tax services provider is recommended for complex tax issues, compliance, and financial planning.

- How does QuickBooks help with business accounting?

QuickBooks bookkeeping and QuickBooks Online bookkeeping services simplify record-keeping, reporting, and financial analysis.

- What industries benefit most from professional accounting?

Industries such as construction, healthcare, e-commerce, and startups benefit greatly from industry-specific accounting services.

- How does professional tax planning help future growth?

Tax planning 2025 and future tax strategies help businesses reduce liabilities and plan expansion effectively.

- What should I look for in an accounting consultancy firm?

Look for experience, transparency, strong tax consultant qualities, and customized accounting solutions.

Final Call to Action – Cashbook Consulting

If your business is struggling with bookkeeping challenges, managing payroll, tax preparation, or financial reporting, Cashbook Consulting is your trusted partner.

We specialize in:

- Professional accounting and tax services

- Payroll services and payroll management

- Outsourced bookkeeping for small businesses

- Tax preparation and tax planning strategies

📊 Let Cashbook Consulting handle your numbers while you focus on growing your business.

📞 Contact us today to get customized accounting solutions that fit your business needs.