Payroll Processing Best Practices for Small Businesses

Effective payroll processing is not just about compliance; it is about efficiency, accuracy, and financial stability. Small business owners who follow payroll best practices reduce errors, avoid penalties, and improve overall financial management.

- Standardizing Payroll Procedures

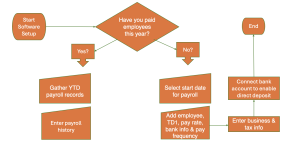

Creating standardized payroll procedures helps ensure consistency. This includes setting payroll schedules, approval workflows, and documentation requirements. Payroll management systems and payroll solutions help automate these procedures.

- Regular Payroll Audits

Conducting internal payroll audits ensures payroll tax management accuracy and helps identify discrepancies early. Many accounting services for small business recommend quarterly payroll reviews.

- Secure Payroll Data Management

Payroll data includes sensitive employee information. Using professional accounting and tax services or payroll outsourcing companies ensures data security and compliance with privacy regulations.

Payroll Processing Challenges Faced by Growing Businesses

As businesses grow, payroll becomes more complex. What works for a five-employee company may fail for a team of fifty.

- Managing Multi-State Payroll Taxes

Expanding businesses often face multi-state payroll tax services requirements. Payroll accountants and tax expert’s accountants help manage varying tax laws accounting across regions.

- Scaling Payroll Systems

Manual payroll methods do not scale well. Payroll management systems integrated with accounting software like QuickBooks Online are essential for scalability.

- Employee Benefits and Deductions

Managing benefits, bonuses, and deductions adds complexity. Professional payroll processing services ensure accurate calculations and reporting.

Payroll Compliance and Risk Management

Payroll compliance is one of the most overlooked risks for small business owners.

- Understanding Payroll Regulations

Payroll regulations vary by industry and location. Professional tax and accounting services help businesses stay compliant with employment laws and tax preparation requirements.

- Penalties for Payroll Non-Compliance

Late payroll tax payments, incorrect filings, or misclassification can result in fines, audits, and legal action. Payroll tax company services reduce these risks.

The Role of Payroll in Financial Reporting Accuracy

Payroll directly impacts accounting reports and financial statements.

- Payroll and Cash Flow Management

Payroll expenses affect cash flow forecasting. Accurate payroll planning improves managing business finances.

- Payroll Data in Financial Statements

Payroll costs appear in income statements and affect profitability analysis. Comprehensive bookkeeping ensures accurate financial reporting.

Payroll Outsourcing Vs In-House Payroll Processing

Choosing between in-house payroll and outsourcing payroll is a major decision for small businesses.

- Benefits of Payroll Outsourcing

- Reduced administrative workload

- Access to payroll tax experts

- Improved accuracy and compliance

- Integration with bookkeeping and tax services

- When In-House Payroll Makes Sense

Some businesses prefer in-house payroll for control, but it requires trained payroll professionals and accounting software expertise.

Payroll Processing for Online and Digital Businesses

Online businesses face unique payroll challenges.

- Payroll for Remote Teams

Managing payroll for remote employees requires accurate payroll tax management and compliance with multiple jurisdictions.

- Bookkeeping for Online Business

Online business bookkeeping must align payroll data with digital revenue streams for accurate accounting bookkeeping.

Future Trends in Payroll Processing and Accounting

Payroll processing continues to evolve with technology and regulation changes.

- Automation and AI in Payroll

Payroll management systems increasingly use automation to reduce errors and processing time.

- Tax Planning Beyond 2025

Future tax strategies require proactive payroll planning and collaboration with tax accounting professionals.

![]() Frequently Asked Questions (FAQs)

Frequently Asked Questions (FAQs)

- What is payroll processing for small businesses?

Payroll processing involves calculating employee wages, managing payroll taxes, issuing payments, and maintaining accurate bookkeeping records.

- Can small businesses outsource payroll processing?

Yes, many small businesses use payroll outsourcing benefits through payroll service providers and professional accounting firms.

- How do payroll services help with tax compliance?

Payroll services manage payroll tax deductions, filings, and payments while ensuring compliance with tax laws accounting.

- What is the difference between payroll and accounting services?

Payroll focuses on employee compensation and taxes, while accounting services for business cover financial reporting, tax planning, and bookkeeping.

- How much do payroll and bookkeeping services cost?

Bookkeeping pricing and payroll costs depend on business size, employee count, and service complexity.

- Is QuickBooks Online good for payroll processing?

Yes, QuickBooks Online payroll integrates well with bookkeeping accounting services and financial reporting.

- What are common payroll mistakes small businesses make?

Common mistakes include incorrect tax calculations, missed deadlines, and poor record-keeping.

- Do startups need professional payroll services?

Yes, startups benefit from professional accounting for startups to ensure compliance and scalable payroll management.

- How often should payroll taxes be filed?

Payroll tax filing frequency depends on jurisdiction and payroll size. Payroll tax services ensure timely filings.

- Can payroll services help during tax season?

Yes, payroll and tax services provide tax season help and accurate documentation for tax preparation.

Final CTA Section

Simplify Payroll Processing with Cashbook Consulting

Managing payroll processing does not have to be stressful or time-consuming. At Cashbook Consulting, we provide payroll processing services, small business payroll solutions, bookkeeping and tax services, and professional accounting and tax support tailored to your business needs.

Our services include:

- Payroll management and payroll tax services

- Outsourced bookkeeping and accounting services

- QuickBooks Online bookkeeping and payroll setup

- Tax preparation and accounting services

- Customized accounting and personalized payroll solutions

With Cashbook Consulting, you gain access to experienced payroll accountants, tax professionals, bookkeeping professionals, and CPA-level accounting expertise—all focused on keeping your business compliant, efficient, and financially healthy.

👉 Let Cashbook Consulting manage your payroll, bookkeeping, and taxes so you can focus on growing your business. Contact us today for reliable, professional payroll and accounting solutions.