The Importance of Compliance in Tax Laws Accounting

Compliance is at the core of how to navigate tax laws with professional accounting advice. Tax authorities expect businesses to maintain accurate bookkeeping records, file timely tax returns, and ensure correct payroll tax management. Failure to comply can result in audits, penalties, interest charges, and reputational damage.

Professional accounting and tax services help businesses interpret complex tax laws accounting requirements and apply them correctly. From tax preparation services to payroll and tax services, compliance-focused accounting reduces risk while supporting long-term financial stability.

Managing Payroll Taxes: A Common Pain Point for Businesses

Managing payroll taxes is one of the most common challenges faced by small business owners. Payroll tax services require precision, consistency, and compliance with changing regulations.

Professional payroll accountants ensure:

- Correct payroll processing

- Accurate withholding and deductions

- Timely tax filings

- Proper payroll planning

Using a payroll management company or payroll outsource company ensures efficient tax handling while freeing business owners from administrative overload.

Hiring a Bookkeeper Vs Outsourcing Accounting Services

Many businesses struggle with the decision of hiring a bookkeeper versus using outsourced accounting firms.

Hiring a bookkeeper is suitable for:

- Daily transaction management

- In-house bookkeeping records

- Small-scale bookkeeping needs

Outsourced accounting and bookkeeping services are better for:

- Tax preparation and bookkeeping

- Financial reporting accuracy

- Strategic financial management

- CPA accounting and consulting

Outsourcing accounting services for small business offers flexibility, expertise, and cost efficiency.

Bookkeeping Pricing, Costs, and ROI

One concern business owners often have is bookkeeping cost and pricing. While professional bookkeeping services require investment, the return is significant.

Benefits include:

- Fewer tax penalties

- Better cash flow management

- Accurate financial statements

- Improved decision-making

Professional bookkeeping professionals help businesses save money by preventing errors and identifying tax-saving opportunities.

Financial Reporting Accuracy and Business Growth

Accurate financial statements are essential for growth. Investors, lenders, and stakeholders rely on accounting reports to assess business performance.

Professional accounting service firms ensure:

- Reliable financial reporting accuracy

- Clear insights into profitability

- Strong business financial practices

Accurate data supports smarter planning and sustainable growth.

Customized Accounting Solutions for Different Business Needs

Every business is different. A professional accounting consultancy firm offers customized accounting and personalized accounting services based on industry, size, and goals.

Customized accounting supports:

- Startups and accounting needs

- Commerce business scalability

- Healthcare accounting services

- Construction bookkeeping services

- Online business bookkeeping

Customization improves efficiency and compliance.

Solving Complex Tax Issues with Advanced Tax Strategies

Some businesses face complex tax issues such as multi-location payroll, international income, or industry-specific deductions.

Tax experts accountants and tax consultant CPA professionals use advanced tax strategies to:

- Reduce liabilities

- Improve tax efficiency

- Ensure compliance

Professional tax & accounting services are essential for businesses with growing complexity.

![]() Frequently Asked Questions

Frequently Asked Questions

What does professional accounting advice include?

Professional accounting advice includes bookkeeping and tax services, payroll management, tax preparation services, financial reporting, compliance support, and strategic tax planning advice.

How do professional accounting services help with tax laws?

Professional accounting services help businesses interpret tax laws accounting requirements, avoid penalties, manage payroll taxes, and ensure accurate filings through expert guidance.

Is outsourced accounting better for small businesses?

Yes. Outsourced accounting services for small business provide access to experienced accounting tax professionals and CPA professional services at a lower cost than full-time staff.

Why are payroll services important for tax compliance?

Payroll services ensure accurate payroll processing, proper tax withholding, timely filings, and compliance with labor and tax laws.

What industries benefit most from professional accounting?

Industries such as construction, healthcare, startups, online businesses, and commerce businesses benefit significantly from professional accounting and tax services.

How does bookkeeping affect tax preparation?

Accurate bookkeeping accounting services ensure clean records, allowing tax professionals to file correct returns, claim deductions, and avoid audits.

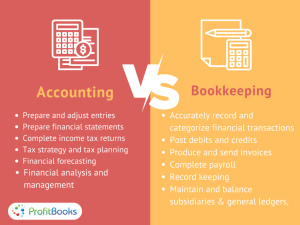

What is the difference between bookkeeping and accounting?

Bookkeeping focuses on recording transactions, while accounting involves analysis, reporting, tax planning, and strategic financial management.

Can QuickBooks replace a professional accountant?

No. While QuickBooks Online bookkeeping services are useful tools, professional accountants ensure accuracy, compliance, and strategic interpretation of financial data.

How often should businesses review their tax strategy?

Businesses should review tax planning strategies annually or whenever tax laws change, especially for tax planning 2025 and future tax strategies.

What should I look for in a tax consultant?

Look for experience, CPA credentials, strong communication, proactive planning, and industry-specific expertise.

Final Call to Action: Cashbook Consulting

Navigating tax laws doesn’t have to be complicated or overwhelming.

At Cashbook Consulting, we specialize in:

- Professional accounting and tax services

- Payroll services and payroll tax management

- Bookkeeping and tax preparation

- Outsourced accounting and bookkeeping services

- Customized accounting solutions for growing businesses

Whether you’re a startup, small business owner, or managing a complex commerce business, our tax & accounting professionals are here to help you stay compliant, reduce risk, and grow with confidence.

📞 Get expert accounting support today.

Contact Cashbook Consulting and let us handle your accounting, payroll, and tax challenges—so you can focus on running your business.