Strategies to Improve Your Business’s Financial Health with Accounting and Bookkeeping

Improving your business’s financial health requires more than just tracking numbers—it demands a proactive, strategic approach that integrates professional tax and accounting services, comprehensive bookkeeping, and reliable payroll management.

Whether you’re a growing startup or an established small business, staying financially healthy is about more than balancing the books. It’s about making informed decisions, maintaining compliance, optimizing cash flow, and setting your company up for long-term success. These goals can only be achieved when your financial operations are managed by experienced professionals who understand the nuances of your industry and local regulations.

At Cashbook Consulting, we specialize in empowering small and medium-sized businesses with the financial tools and insights they need to thrive in a competitive marketplace. Our services go beyond simple number-crunching—we offer strategic financial planning, accurate bookkeeping, timely tax preparation, and fully managed payroll solutions tailored to your unique needs.

In this comprehensive guide, we’ll walk you through proven methods to improve your financial operations, reduce unnecessary costs, avoid common tax pitfalls, and ensure your back office supports the growth of your front-end operations. Whether you’re struggling with late payroll filings, disorganized books, or unclear financial reporting, our expert guidance will help you navigate your business finances with confidence.

Let’s dive into how you can enhance your company’s financial health through expert accounting, bookkeeping, and payroll management services—so you can focus on what you do best: growing your business.

Understanding the Importance of Professional Bookkeeping Services

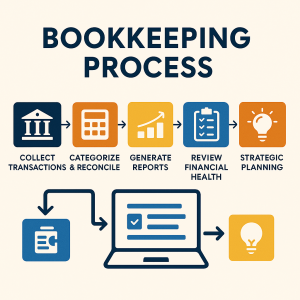

Bookkeeping is the cornerstone of any sound financial management system and plays a critical role in the overall health and success of a business. Without accurate and timely financial records, it becomes difficult—if not impossible—to understand where your business stands financially, let alone make informed decisions about budgeting, forecasting, or investing.

By leveraging professional bookkeeping services, small business owners can ensure that every financial transaction—whether it’s income, expenses, payroll, or taxes—is properly recorded, categorized, and reconciled. This creates a clear and organized view of your company’s financial position at any given moment.

Accurate bookkeeping not only supports compliance with local and federal tax regulations, but also helps streamline your year-end reporting, making audits, tax filings, and financial reviews significantly easier and less stressful. More importantly, up-to-date financial data gives you the tools to evaluate profitability, monitor cash flow, and identify areas for cost savings or business growth.

At Cashbook Consulting, our bookkeeping professionals use cutting-edge tools and cloud-based platforms like QuickBooks Online, Zoho Books, and Xero to ensure your books are always current, accessible, and audit-ready. Whether you’re dealing with daily transactions, monthly reconciliations, or backlog cleanup, our bookkeeping services for small business provide the accuracy and insight needed to stay financially strong and scalable.

Common Problems with DIY Bookkeeping

Many small businesses face ongoing challenges when it comes to maintaining accurate and organized financial records. Common problems such as missed entries, inconsistent reporting, and failure to properly utilize modern bookkeeping software often lead to more serious financial consequences over time.

When transactions are not recorded correctly or timely, it creates discrepancies in financial statements that can mislead business owners about their actual financial position. This not only hampers decision-making but also creates confusion during tax season or when applying for loans. Inaccurate or incomplete books may result in tax errors, including missed deductions, incorrect filings, or even late submission penalties—all of which can attract scrutiny from tax authorities and result in fines or audits.

Another major consequence of poor bookkeeping is disruption in cash flow management. Without a clear picture of income, expenses, receivables, and payables, business owners may find themselves short on cash unexpectedly. This can affect everything from paying suppliers on time to meeting payroll obligations, ultimately damaging vendor relationships and employee trust.

The root cause of these issues often lies in the lack of skilled staff, outdated processes, or failure to invest in professional bookkeeping services. At Cashbook Consulting, we help eliminate these pain points by providing comprehensive bookkeeping solutions for small businesses, using powerful cloud accounting tools to deliver consistent reporting, real-time insights, and year-round financial accuracy.

The Role of Payroll Services in Financial Stability

Efficient and accurate payroll services are essential for any business that values employee satisfaction, legal compliance, and operational efficiency. For small businesses in particular, payroll is more than just issuing paychecks—it involves a complex web of tasks including salary calculations, tax withholdings, benefit deductions, and timely government reporting. Mismanaging any of these components can result in significant consequences.

From delayed payments to incorrect tax filings, payroll mistakes can lead to serious employee dissatisfaction, reduced morale, and in some cases, staff turnover. Additionally, payroll tax errors or failure to comply with government regulations can trigger costly penalties, audits, and legal troubles. For example, missing deadlines for payroll tax deposits or filing incorrect forms like 941s or W-2s can invite fines from the IRS or state agencies.

This is why smart business owners turn to professional payroll services to ensure every aspect of their payroll cycle is handled accurately and on time. A dedicated provider brings specialized knowledge of local and federal payroll laws, ensures consistent compliance, and can adapt quickly to changes in legislation or workforce structure.

At Cashbook Consulting, we offer end-to-end payroll management solutions that are tailored to your specific business needs. Whether you employ a small team or are scaling up rapidly, our business payroll services include automated pay runs, direct deposits, payroll tax filings, benefits tracking, employee portals, and detailed payroll reports. We use industry-leading platforms like QuickBooks Payroll, ADP, and Wagepoint to simplify the entire process while keeping your business fully compliant.

By outsourcing payroll to Cashbook Consulting, you reduce the administrative burden on your team, eliminate the risk of penalties, and ensure your employees are always paid correctly and on time—creating a healthier, more productive workplace.

Managing Payroll Taxes and Compliance

One of the most significant and often underestimated challenges in small business payroll is the accurate and timely management of payroll tax services. Employers are responsible for calculating, withholding, depositing, and reporting a variety of federal, state, and sometimes local payroll taxes. These include income tax withholdings, Social Security, Medicare, unemployment taxes, and more—each with its own set of rules, deadlines, and reporting requirements.

Unfortunately, many small businesses lack the internal resources or expertise to manage these responsibilities effectively. As a result, late filings, underpayments, or incorrect tax submissions are common and can lead to hefty fines, interest charges, and in some cases, government audits. Even small mistakes—like using the wrong form or missing a quarterly deadline—can trigger costly penalties and drain your business’s time and resources.

That’s why outsourcing payroll tax services is one of the smartest moves a small business can make. By partnering with a professional payroll service provider, you minimize the risk of non-compliance and free up internal bandwidth to focus on core business operations. With the right partner, your business can benefit from automated tax calculations, timely submissions, up-to-date knowledge of tax law changes, and accurate year-end reporting for forms like W-2s and 1099s.

At Cashbook Consulting, our payroll tax specialists handle everything from payroll setup and employee classification to ongoing tax compliance and filings. Our team stays current on all tax updates and regulatory changes so you don’t have to. By using trusted payroll software and automated tools, we ensure your small business payroll is always accurate, compliant, and hassle-free.

With outsourced payroll solutions, you not only avoid compliance pitfalls but also gain peace of mind, improved accuracy, and a more efficient payroll process—giving you the confidence to grow your business without worrying about tax-related surprises.

Choosing Between Bookkeeping and Accounting Services

While bookkeeping focuses on recording daily financial transactions, professional accounting services take those records and transform them into actionable financial insights. Bookkeeping ensures your business keeps accurate logs of income, expenses, assets, and liabilities, but it’s only the first step in building a healthy financial foundation. To truly understand and improve your business’s financial performance, you need the expertise of an accountant who can analyze your financial data, interpret trends, and offer strategic advice.

Professional accounting services go far beyond tax filing and compliance. They include creating financial statements like profit and loss reports, balance sheets, and cash flow statements. Accountants also provide budgeting assistance, financial forecasting, cost-benefit analysis, and guidance on critical decisions such as pricing, cost control, expansion, and investment planning. These insights help small business owners set realistic goals, avoid financial pitfalls, and capitalize on growth opportunities.

For most small businesses, separating bookkeeping from accounting creates gaps in their financial workflow. Bookkeepers may track every dollar in and out, but without an accountant’s interpretation, it’s difficult to see the bigger picture. That’s why combining bookkeeping and accounting services offers the most comprehensive financial support—ensuring you have both accuracy in your records and clarity in your financial direction.

At Cashbook Consulting, we offer integrated bookkeeping and professional accounting services that work in sync to give you a complete view of your business’s financial health. Our team ensures your records are always up to date and uses that information to deliver custom reports, KPI tracking, and actionable recommendations tailored to your goals. Whether you’re navigating a challenging quarter or preparing for expansion, our small business accounting support helps you stay informed, compliant, and prepared to make smarter financial decisions.

Bookkeeping vs. Accounting Services

Bookkeepers and accounting tax professionals play distinct yet complementary roles in a business’s financial ecosystem, and understanding the difference between the two is essential for maintaining both accuracy and strategic direction.

Bookkeepers are responsible for the day-to-day recording of financial transactions, including sales, purchases, receipts, and payments. They ensure that your general ledger is up to date, categorize expenses properly, reconcile bank statements, and maintain organized records that are the foundation of your financial system. The focus of bookkeeping services is accuracy, consistency, and ensuring that all financial data is properly recorded and ready for review or analysis.

On the other hand, accounting tax professionals take this detailed financial data and perform deeper analysis to generate meaningful insights. Their role involves reviewing the financial statements prepared from bookkeeping records, identifying trends, preparing comprehensive tax reports, and ensuring full compliance with local, state, and federal regulations. Beyond tax filings, these professionals offer strategic financial advice—helping businesses with budgeting, forecasting, financial planning, and decisions related to business growth, investments, or restructuring.

While bookkeepers keep the financial engine running smoothly on a daily basis, it is the accounting and tax professionals who provide the insights necessary to steer the business in the right direction. When both roles work together, they create a powerful financial management system that ensures accuracy, compliance, and long-term success.

At Cashbook Consulting, we offer both professional bookkeeping services and expert accounting support under one roof, allowing your business to benefit from seamless collaboration, real-time data insights, and a clear path toward financial growth.

Outsourced Bookkeeping: A Smart Solution for Growing Businesses

Outsourced bookkeeping services offer small and medium-sized businesses a highly efficient, reliable, and cost-effective solution to managing their financial records. Instead of bearing the expense and administrative burden of hiring full-time, in-house staff, business owners can tap into a team of experienced bookkeeping professionals who are trained to handle a wide range of accounting tasks with precision and efficiency.

By outsourcing, companies gain access to expert-level talent that understands the nuances of financial recordkeeping, tax compliance, and industry-specific accounting practices—without the added costs of salaries, benefits, training, or office space. This makes outsourced bookkeeping a smart financial decision, especially for startups and growing businesses that need professional support but want to stay lean.

Another major advantage is consistency and accuracy in financial reporting. With outsourced services, you’re no longer relying on a single employee who may take leave, resign, or make errors due to multitasking. Instead, a dedicated team ensures your books are always current, your bank statements are reconciled, and your general ledger remains organized. Regular reports, dashboards, and reviews allow you to make timely decisions backed by real data.

At Cashbook Consulting, our outsourced bookkeeping services are designed to deliver reliability, clarity, and peace of mind. We use secure, cloud-based software like QuickBooks Online, Xero, and Zoho Books to maintain real-time access to your financial data, allowing you to collaborate with our team anytime, anywhere. From managing daily transactions to preparing month-end reports, we ensure that your financial foundation is solid and scalable.

Benefits of Outsourced Accounting and Bookkeeping Services

By partnering with a professional accounting firm, you gain access to Certified Public Accountant (CPA) financial accounting expertise, highly accurate financial statements, and end-to-end tax and payroll solutions—all while freeing up your time to focus on growing your core business.

Small business owners often wear many hats, but handling complex financial tasks shouldn’t be one of them. With the support of experienced accountants and bookkeepers, your financial data is not only recorded correctly, but also analyzed to provide a clear picture of your company’s performance, profitability, and cash flow health.

CPA-level support means your business benefits from deep financial insight, audit-ready reports, and expert guidance on everything from budgeting and forecasting to regulatory compliance and investment planning. Whether you need help managing payroll taxes, preparing quarterly filings, or generating timely income statements and balance sheets, a professional team ensures every detail is handled with precision.

At Cashbook Consulting, our clients gain access to a full spectrum of services—including CPA financial accounting, accurate financial reporting, and customized tax and payroll solutions—so they can shift their focus from tedious back-office tasks to strategic business growth. We serve as your behind-the-scenes financial engine, making sure you stay compliant, organized, and empowered to make smarter decisions.

Tax Preparation and Planning for 2025 and Beyond

Proactive tax planning strategies are essential for businesses looking to reduce their tax liabilities, maximize allowable deductions, and maintain full compliance with evolving tax regulations. Rather than scrambling to meet filing deadlines or reacting to tax bills at the end of the year, successful businesses take a forward-thinking approach by planning their tax strategy throughout the fiscal year.

Tax planning involves more than just tallying up numbers—it’s about understanding your business structure, income patterns, eligible expenses, and long-term financial goals. With this insight, a skilled accounting team can identify valuable tax-saving opportunities, such as timing deductions, leveraging credits, adjusting payroll withholdings, or optimizing business expenses for maximum benefit.

Whether you’re a sole proprietor, LLC, S-corp, or C-corp, every business can benefit from customized accounting and tax guidance tailored to its unique needs. Working with seasoned tax and accounting professionals ensures you’re not missing out on deductions, overpaying on quarterly estimates, or risking penalties for late or inaccurate filings. Preparation isn’t just a formality—it’s the foundation of financial efficiency.

At Cashbook Consulting, our team offers comprehensive tax preparation services backed by proactive planning strategies. We analyze your financials in real time, provide tax forecasting, and guide you on year-round decisions that impact your tax outcome—so you’re never caught off guard. Our goal is to minimize your tax burden while keeping you in full compliance with local, state, and federal laws.

Common Issues in Tax Preparation

Missing receipts, misclassified expenses, and unfamiliarity with new tax laws are some of the most common—and costly—mistakes small businesses make during tax season. These errors can lead to inaccurate financial statements, overpaid taxes, missed deductions, and even red flags that trigger IRS audits or penalties. For business owners who are already juggling operations, employees, and customer relationships, the complexity of tax compliance can quickly become overwhelming.

For example, missing receipts can invalidate business deductions, leading to higher taxable income and a bigger tax bill. Misclassified expenses—such as personal expenses labeled as business, or capital expenditures incorrectly logged as operational costs—can distort your financial reports and create complications during audits or loan applications. Even more concerning, many business owners are not aware of new or updated tax laws, including changes in allowable deductions, credits, and reporting obligations, which change frequently at both federal and state levels.

That’s where professional tax and accounting services become essential. At Cashbook Consulting, our expert CPAs and tax advisors stay up to date with the latest tax code changes, ensuring your filings are always accurate and optimized. We offer comprehensive tax preparation services that include organizing your documents, reviewing transactions for compliance, identifying all eligible deductions, and preparing your returns with accuracy and confidence.

Our goal is simple: to help you avoid costly errors, reduce your tax burden, and ensure full compliance. With our proactive support, you no longer have to worry about digging through piles of receipts or second-guessing your deductions—we handle everything with professionalism and precision.

QuickBooks Online and Software Tips for Modern Businesses

Using advanced tools like QuickBooks Online for your accounting and bookkeeping needs is a game-changer for small and medium-sized businesses seeking efficiency, accuracy, and scalability. As a cloud-based platform, QuickBooks Online offers powerful features that streamline your daily financial operations, reduce manual data entry, and ensure that your financial records are always current and accessible from anywhere.

One of the most significant benefits of QuickBooks Online is its ability to improve reporting accuracy. With real-time bank feeds, automated transaction categorization, and built-in error detection, the software helps eliminate common mistakes such as duplicate entries, missed transactions, or unbalanced ledgers. Business owners and accountants can generate detailed financial reports—such as profit and loss statements, balance sheets, and cash flow forecasts—at the click of a button, making it easier to monitor financial performance and make data-driven decisions.

QuickBooks also integrates seamlessly with a variety of business tools, most notably payroll systems. With integrated payroll management, business owners can automate pay runs, calculate tax withholdings, manage benefits, and generate pay stubs all within the same platform. This not only improves efficiency but also ensures compliance with payroll tax regulations by automatically syncing payroll data with your general ledger.

At Cashbook Consulting, we specialize in helping businesses get the most out of their accounting and bookkeeping software. From setting up QuickBooks Online and customizing your chart of accounts to training your staff and managing ongoing entries, we ensure you take full advantage of this powerful tool. Our team also provides bookkeeping, payroll, and tax services that are fully integrated with QuickBooks, offering you a centralized, streamlined financial system that grows with your business.

QuickBooks for Bookkeeping and Payroll Management

From chart of accounts setup to automated payroll tax filings, QuickBooks Online (QBO) provides a comprehensive, user-friendly platform that’s ideally suited for managing bookkeeping services for small businesses. Designed with simplicity and scalability in mind, QBO enables business owners and accountants to manage core financial tasks with ease—whether you’re a solopreneur just getting started or a growing team looking to streamline your operations.

Setting up a well-organized chart of accounts is the foundation of effective bookkeeping. With QBO, this process is simplified through built-in templates and customization options that allow you to tailor account categories to match your specific industry, business model, and reporting needs. Once the chart of accounts is in place, every transaction—whether it’s a sale, expense, invoice, or payment—can be properly classified and tracked, giving you a clear picture of your financial activity at any time.

Beyond standard accounting tasks, QuickBooks Online shines in its ability to handle payroll functions, including automated pay runs, employee benefit tracking, and payroll tax filings. It ensures compliance by calculating and submitting payroll taxes on your behalf, eliminating the risk of missed deadlines or costly penalties. The system also generates and files W-2s, 1099s, and other essential tax forms with just a few clicks.

Because QBO is cloud-based, it offers real-time access to financial data, seamless bank integration, and multi-user collaboration features. This makes it the ideal tool for bookkeeping professionals and small business owners alike, offering a centralized hub for all accounting, payroll, and tax-related activities.

At Cashbook Consulting, we help clients harness the full power of QuickBooks Online by handling everything from initial setup and monthly reconciliation to payroll integration and tax reporting. Our team of certified professionals ensures that your bookkeeping system is clean, compliant, and perfectly aligned with your business goals.

Why Cashbook Consulting is the Right Choice

At Cashbook Consulting, we bring together advanced payroll management systems, professional tax preparation help, and expert accounting consultancy to deliver a fully integrated financial solution that drives your business’s long-term success. Our holistic approach ensures that every aspect of your financial operations is not only accurate and compliant, but also optimized for efficiency, growth, and profitability.

With our payroll management systems, we automate pay runs, tax withholdings, and benefit calculations, ensuring that your employees are paid accurately and on time. We also handle all payroll tax filings, including quarterly and year-end reports, so you can avoid penalties and stay in good standing with tax authorities. Whether you have a team of two or twenty, our customized payroll services are designed to scale with your business.

In addition to payroll, our tax preparation services help small businesses stay ahead of filing deadlines, reduce tax liabilities, and take advantage of every available deduction. We provide year-round support—not just during tax season—by proactively monitoring your financials and adjusting your tax strategy as needed. Our team stays updated on the latest IRS regulations and tax law changes so that you don’t have to.

What truly sets us apart is our expert accounting consultancy. We go beyond the numbers to provide actionable insights into your business’s financial health. From budgeting and forecasting to cash flow management and KPI tracking, our consultants help you make informed decisions that support sustainable growth.

By offering all these services under one roof, Cashbook Consulting ensures that your business’s bookkeeping, tax, payroll, and accounting needs are handled with precision, care, and forward-thinking strategy. This integrated approach saves you time, reduces costs, and allows you to focus on what you do best—running and growing your business.

Industry-Specific Accounting Needs

Different industries face unique financial challenges that require customized accounting and bookkeeping solutions to ensure accurate reporting, regulatory compliance, and sustainable growth. A one-size-fits-all approach simply doesn’t work when it comes to managing the finances of businesses in diverse sectors. That’s why industry-specific knowledge is essential when selecting the right professional accounting and bookkeeping services.

For example, the healthcare industry deals with complex financial workflows involving patient billing, insurance reimbursements, medical coding, and strict compliance with HIPAA and other regulatory standards. Medical accounting services must ensure that all financial transactions are accurately recorded while also helping clinics and practitioners manage revenue cycles, track outstanding insurance claims, and handle financial reporting for grants or nonprofit initiatives.

Construction businesses, on the other hand, require a completely different approach. Construction bookkeeping services focus on tracking job costing, project budgets, materials procurement, equipment usage, progress billing, and subcontractor payments. Because construction projects often span weeks or months and involve multiple vendors, maintaining accurate cost tracking and cash flow forecasting is crucial. Improper bookkeeping can result in underbidding projects, delayed payments, or regulatory non-compliance with union and contractor agreements.

Startups represent another sector with unique accounting needs. Often operating with limited resources, startups must manage rapid growth, unpredictable expenses, and high-pressure investor reporting. They need accounting advice for startups that includes budget forecasting, burn rate monitoring, R&D tax credits, and preparing financial statements for fundraising rounds. Proper financial planning and reporting can make the difference between attracting venture capital or struggling to stay afloat.

At Cashbook Consulting, we offer tailored bookkeeping and accounting solutions designed to meet the specific needs of your industry. Whether you’re in healthcare, construction, eCommerce, real estate, or launching your first tech startup, we understand your financial pain points and deliver services that solve them. Our team ensures you receive not only accurate numbers but also industry-relevant insights that help your business thrive in its unique environment.

Financial Reporting and Forecasting

Accurate financial statements and reliable financial reporting are fundamental to maintaining control over your business finances and achieving long-term stability. Without precise and up-to-date records, business owners are essentially operating in the dark—making decisions based on assumptions rather than facts. Reliable financial data is essential not only for day-to-day operations but also for strategic planning, compliance, and communicating with external stakeholders.

At the core of dependable financial reporting lies comprehensive bookkeeping. This involves recording every business transaction—whether it’s income, expenses, payroll, or asset purchases—in a timely and organized manner. When all financial activities are properly categorized and reconciled, it ensures that financial statements such as the profit and loss report, balance sheet, and cash flow statement are accurate and reflective of the business’s true financial position.

These reports provide the foundation for financial forecasting and budgeting. With access to clean, organized financial data, businesses can create realistic budgets, predict future cash flows, and anticipate upcoming expenses or revenue dips. This allows for better decision-making when it comes to cost-cutting, investments, hiring, or scaling operations.

Additionally, businesses that generate and maintain detailed accounting reports are in a stronger position to secure business loans, attract investors, and demonstrate credibility with banks, lenders, or regulatory bodies. Investors and financial institutions often require several years of consistent, well-prepared financial reports before approving funding or entering into partnerships. Without reliable financial documentation, growth opportunities may be delayed or missed entirely.

At Cashbook Consulting, we provide professional bookkeeping and accounting services that ensure your financial records are complete, accurate, and readily available when you need them most. Our services empower you to manage your financial practices more effectively, navigate tax season with ease, and make well-informed operational and strategic decisions that support your business’s success.

Advanced Tax Planning Strategies for 2025

Looking ahead, proactive tax planning is one of the most effective ways to achieve meaningful savings and improve your business’s financial health. Rather than waiting until tax season to review your finances, taking a forward-thinking approach allows you to identify savings opportunities throughout the year and minimize your overall tax liability. The earlier you begin planning, the more control you have over your taxable income, deductions, and cash flow.

By working closely with a professional tax consultant, you gain access to expert insights on how to prepare for new and evolving tax laws, apply the most current tax codes, and structure your finances in a way that’s both compliant and advantageous. These professionals stay updated on legislative changes, IRS guidelines, and local tax requirements—so you can focus on running your business while knowing your tax strategy is sound.

Future tax strategies go far beyond simple deductions. They include evaluating your current entity structure (LLC vs. S-Corp, for example), forecasting your income, adjusting quarterly estimated payments, and reviewing potential changes in depreciation rules, tax credits, or employment incentives. For instance, planning capital purchases, charitable contributions, or bonuses before the end of December can significantly impact your taxable income for the current year.

Maintaining updated bookkeeping records is a critical component of proactive planning. Clean, accurate, and real-time financial data ensures your tax consultant can offer the best guidance and prevent last-minute errors or missed opportunities. Additionally, regular consultations with your tax advisor throughout the year—not just during filing season—allow for dynamic adjustments and more accurate projections.

At Cashbook Consulting, our tax preparation and accounting services are designed to help businesses stay ahead of tax changes, avoid compliance issues, and optimize their tax position well in advance of key deadlines. We provide year-round support that includes tax forecasting, compliance monitoring, and strategic planning—all tailored to your industry, revenue model, and growth goals.

Let our team of accounting and tax professionals help you develop a long-term tax strategy that not only reduces your liabilities but also strengthens your overall financial position for the future.

Why Payroll Outsourcing is a Smart Move

Outsourcing payroll services offers a wide range of benefits for small and mid-sized businesses, especially those looking to improve efficiency, reduce costs, and stay compliant with ever-changing payroll regulations. Managing payroll internally can be time-consuming and error-prone, particularly when handled by individuals who may not be fully trained in the latest tax laws, filing requirements, or benefit calculations.

By partnering with a trusted payroll outsource company like Cashbook Consulting, you eliminate many of the common risks associated with in-house payroll processing. These include calculation errors, misfiled tax forms, late payments, and potential non-compliance with state and federal labor regulations. Even a minor mistake in payroll tax filings can result in costly penalties, delayed employee payments, or issues with year-end reporting.

Our payroll service providers manage the entire process from start to finish—ensuring your employees are paid accurately and on time, every time. We handle everything from processing regular pay runs and managing benefit deductions to calculating overtime, issuing direct deposits, and preparing tax forms like W-2s and 1099s. In addition, we take care of all payroll tax submissions, ensuring that your business remains fully compliant with all local, state, and federal payroll laws.

One of the most significant advantages of outsourced payroll services is the time and energy it saves. Instead of devoting valuable internal resources to payroll tasks, your team can focus on what matters most—growing your core operations and delivering excellent service to your clients. There’s also no need to hire, train, or manage an in-house payroll specialist, which further reduces overhead costs.

At Cashbook Consulting, we use secure, cloud-based payroll systems that allow for real-time access, full transparency, and seamless integration with your bookkeeping and accounting platforms. Whether you have five employees or fifty, our small business payroll management solutions are tailored to your specific needs and designed to grow with your business.

With Cashbook Consulting handling your payroll, you gain peace of mind, improved accuracy, timely reporting, and a partner that is fully committed to supporting your business’s financial health.

Frequently Asked Questions (FAQs)

What’s the difference between bookkeeping and accounting?

Bookkeeping is the process of recording daily financial transactions, such as sales, expenses, payroll entries, and payments. It serves as the foundational layer of your financial system, ensuring your general ledger stays accurate and organized.

Accounting, on the other hand, builds on bookkeeping data to provide financial analysis, generate reports, ensure tax compliance, and guide strategic decision-making. Accountants interpret your financial information to prepare income statements, balance sheets, and tax returns while offering advice on budgeting, forecasting, and profitability.

Why should I outsource my accounting services?

Outsourcing accounting services is a cost-effective way to gain access to experienced professionals without the overhead of hiring a full-time, in-house team. It reduces the risk of errors, improves tax and regulatory compliance, and frees up your time to focus on core business activities.

At Cashbook Consulting, our outsourced accounting and bookkeeping services are tailored to your business needs, giving you real-time insights, financial clarity, and strategic support—without the full-time expense.

Is QuickBooks suitable for small business payroll?

Yes. QuickBooks Online offers fully integrated payroll solutions that are ideal for small businesses. It automates pay runs, handles employee tax withholdings, manages benefits and deductions, and files payroll taxes directly with the IRS and state agencies.

Whether you have one employee or a growing team, QuickBooks streamlines payroll processing and integrates seamlessly with your accounting system. Cashbook Consulting provides complete QuickBooks setup, training, and payroll integration to help you get the most out of the platform.

How can I ensure tax compliance?

To stay compliant, you need to meet all tax filing deadlines, apply the latest tax rules, maintain accurate financial records, and identify all eligible deductions. This is best achieved by working with a professional tax consultant or tax preparer company like Cashbook Consulting.

We help businesses navigate complex tax regulations, prepare timely returns, optimize deductions, and avoid penalties. Our tax preparation and accounting services are designed to ensure year-round compliance, not just during tax season.

How often should I update my bookkeeping records?

Your bookkeeping records should ideally be updated weekly, especially for fast-growing businesses with a high volume of transactions. At a minimum, monthly updates are necessary to maintain financial accuracy, track cash flow, and prepare for tax filings.

Frequent updates reduce the risk of missing transactions, help with timely decision-making, and make tax preparation far easier. Cashbook Consulting offers customized bookkeeping schedules that match your business’s pace and complexity.

What are the signs I need professional bookkeeping help?

If you’re experiencing any of the following, it’s time to hire professional bookkeepers:

- Repeated tax penalties or missed deadlines

- Late invoices or delayed payment processing

- Disorganized or unbalanced ledgers

- Unclear or inaccurate cash flow reports

- Difficulty reconciling bank accounts or tracking expenses

At Cashbook Consulting, we solve these problems with personalized, industry-specific bookkeeping services that bring accuracy and consistency to your financial management.

Can you help with QuickBooks setup and training?

Yes, absolutely. We offer end-to-end QuickBooks Online setup and training services. This includes creating a custom chart of accounts, connecting your bank feeds, setting up automation rules, configuring payroll and tax modules, and offering tips for using reports and dashboards effectively.

Whether you’re new to QuickBooks or need help optimizing your setup, Cashbook Consulting’s certified QuickBooks experts ensure you’re set up for success.

Do you provide bookkeeping for online businesses?

Yes, we specialize in bookkeeping services for online businesses, including eCommerce retailers, digital service providers, SaaS companies, and remote teams. Our cloud-based accounting solutions are designed to integrate seamlessly with platforms like Shopify, Stripe, PayPal, Amazon, and QuickBooks Online.

Whether you’re selling on multiple channels or running an online agency, Cashbook Consulting ensures your books are clean, your taxes are optimized, and your financials are always investor-ready.

✅ Ready to Elevate Your Business Finances? Let Cashbook Consulting Lead the Way.

At Cashbook Consulting, we don’t just manage your books—we empower your business with precision, insight, and peace of mind. Whether you’re a startup struggling with payroll, an eCommerce brand chasing growth, or a service provider overwhelmed by tax deadlines, we’re here to simplify your finances and help you scale with confidence.

💼 What We Offer:

- 📊 Seamless Bookkeeping Services for Small Business

- 💵 Expert Payroll Management & Compliance

- 🧾 Strategic Tax Preparation & Filing

- 🧠 Actionable Financial Analysis & Reporting

- 🖥️ End-to-End QuickBooks Online Setup & Training

🎯 With our outsourced accounting and bookkeeping solutions, you get enterprise-level support without the enterprise-level price tag. We’re cloud-powered, people-focused, and obsessed with helping businesses like yours thrive.

🌟 Don’t Let Financial Stress Hold You Back. Let’s Build Your Back Office to Power Your Front-End Growth.

📅 Book Your Free Consultation Today!

📍 Visit: https://cashbookacc.com

📞 Call: +1 (201) 979-3825

📧 Email: support@cashbookacc.com

Cashbook Consulting – Where Numbers Make Sense, and Businesses Make Progress.

Let’s turn your financial chaos into crystal-clear clarity—starting now.